MARKET STRUCTURE DICTIONARY

BY

BRIAN W. LEITE

An Insider's Guide to the Real Language of

Trading and Exchanges

Over 2700 Entries

laggard An underperforming stock.

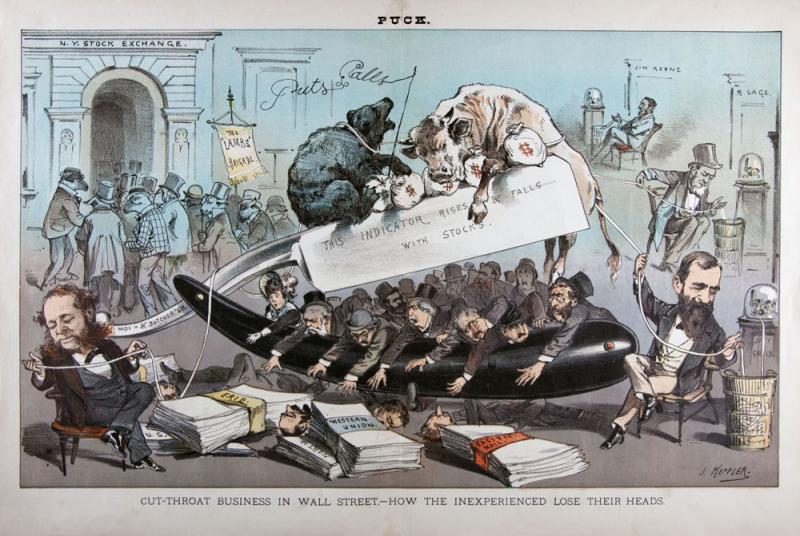

lamb A slang term for an inexperienced or unsophisticated trader. For example, This kind of choppy market will separate the lambs from the pros fairly quickly.

The "Lambs Brigade" is blissfully unaware of what awaits them once the big operators move against them, circa 1881

The "Lambs Brigade" is blissfully unaware of what awaits them once the big operators move against them, circa 1881

Photo Credit: Museum of American Finance

large 1. As a general indication of size, means at least 25,000 shares. For example, ZVZZT, I'm a large buyer in line. 2. As an official INDICATION OF INTEREST, expresses a general willingness to buy or sell at least 25,000 shares with a customer depending on the relationship, the market price, and the available liquidity. For example, ZVZZT, I'm indicated as a large seller, so I'll offer your guy 25,000 at $25.50 to work larger. See also SMALL, MEDIUM, and SIZE.

large capitalization (cap) stock The stock of a corporation with a high market value, usually in excess of $5 billion.

large trader 1. In general, a trader who accounts for a substantial percentage of the overall trading volume. See also AX. 2. More specifically, the Securities and Exchange commission defines a large trader as a person whose transactions in NMS securities equals or exceeds two million shares or $20 million during any calendar day, or 20 million shares or $200 million during any calendar month.

last, the An abbreviation for last sale. For example, Hey, my systems just crashed. Can you tell me the last in XYZ?

last sale 1. The execution price of the most recent trade in a specific stock on a particular exchange. 2. The execution price of the most recent trade in a specific stock on the consolidated tape. 3. A synonym for closing price.

last sale reporting A notice provided by OTC equity market participants to FINRA of the price and quantity of each negotiated (non-electronic) trade. During normal market hours, as well as during pre-market session and after market session, these details must be sent electronically within ten seconds of execution. See also TRADE REPORTING.

late tape A significant delay in the display of market data on an exchange tape due to unusually heavy volume.

late to… Market maker lingo that basically means "I will not trade with you at my quoted price because I have already traded with a competitor (or a customer) at that price very recently." For example, ZVZZT, you're late to competition at a quarter. I'm eighth best now. See also COMPETITION AHEAD and RETAIL AHEAD.

latent trader An academic term for a trader who has not officially entered an order but would likely trade if approached by a suitable counterparty.

latency arbitrage An arbitrage technique in which HIGH FREQUENCY TRADERS with collocated servers and direct data feeds from the various market centers are able to ascertain the true National Best Bid and Offer in a stock faster than traders who merely subscribe to the consolidated quotation system. Using high speed gaming techniques, HFT algos determine how such a change to the NBBO will affect trading patterns in the stock order to front run existing orders.

Lava Trading A technology vendor that provided trading firms with systems to integrate order books from various exchanges, ECNs, and other liquidity providers. Lava also offerd an order management system and maintained its own ECN. Purchased by Citigroup in 2004, and closed in 2014.

lay off Eliminate a position by making an offsetting trade with a customer or another dealer.

lay up A slang term for a particularly easy trade. For example, John, your loss ratio here is over 20%. Can't you just give us a couple of lay up trades to get it down to a more reasonable level?

layering Entering multiple limit orders on one side of the market with the intention of gaining a more favorable execution price on the other side of the market. For example, a trader (or a HIGH FREQUENCY TRADING program) may establish a long position and subsequently place several separate buy orders at prices at or slightly away from the best bid. Other buyers in the market may believe they have competition and are therefore forced to pay higher prices. The trader can therefore sell his position at prices he would not otherwise have been able to achieve.

leader An active stock that sets the tone for the rest of the market.

leading the market Moving in advance of other stocks that will likely soon follow suit. May provide statistical arbitrage opportunity.

leakage The premature and/or selective release of nonpublic information.

leaves The unexecuted portion of an order that remains following a partial execution, as in ZVZZT, you bought 25,000 at $25.50, leaves 75,000.

legitimate See NATURAL.

legs Positions within an arbitrage trade.

lemming A slang term for a trader that tends to follow the crowd. For example, Look at all the lemmings piling into ZVZZT. I'm guessing this won't end well. See HERD INSTINCT.

lemon An unprofitable trade.

lessee member A person who leases only the trading privileges of an exchange membership from a member who actually owns the seat. A lessee member therefore does not receive full membership privileges.

letter stock Another term for unregistered stock.

level A price indication, as in ZVZZT, I'm in touch with a seller up at the $25 level.

Level 1 A subscription service offered by NASDAQ that provides real time quotes for the NBBO in NASDAQ and OTC Bulletin Board stocks.

Level 2 A subscription service offered by NASDAQ that supplies all Level 1 data as well as provides the real time top of file position for every market maker and ECN in NASDAQ, NYSE, and Amex stocks. Also provides order entry firms with the ability to enter and execute trades in all NASDAQ automated systems.

Level 3 Historically, the basic trading platform available to NASDAQ market makers. Comprised of both the information available to Level 2 quote subscribers as well as quoting, trading, and reporting functionality. Now part of the NASDAQ MarketCenter.

leverage 1) The use of debt to partially finance an equity position. See also MARGIN. 2) The use of derivatives to increase net equity exposure while minimizing costs.

lie down Refuse to honor a trading obligation. See also FALL DOWN and BACK AWAY.

lift An increase in prices, as in XYZ is really getting a lift on that ZVZZT news.

lift the offers 1. In general, means to buy stock from the traders quoting the best ask. Usually implies bidding for enough stock to remove all liquidity at the best ask thereby establishing a new higher asked price. 2. More specifically, OTC traders lift the offers by simultaneously bidding each market maker posted at the best ask. For example, ZVZZT, I'm going to lift the offers at $25 and then bid for your balance there. Also called take the offers. Opposite of HIT THE BIDS.

lighten up To reduce, but not eliminate, a position, as in I think I'm going to lighten up a bit before the Fed announcement.

limit An abbreviation for limit price. The highest (lowest) price a trader is willing to pay for (sell) stock. For example, Sell 50,000 XYZ with a $50.20 limit.

limit (price) The highest (lowest) price a trader is willing to pay for (sell) stock, as in Sell 30,000 XYZ with a $50.20 limit.

limit on close order An order to buy or sell a stock at the official exchange closing price if and only if the closing price is at (or better than) the limit price on the order.

limit on open order An order to buy or sell a stock at the official exchange opening price if and only if the opening price is at (or better than) the limit price on the order.

limit order An order to buy (sell) a stock at or below (above) a specified price. Sell 50,000 XYZ with a $50.20 limit or Buy 25,000 ZVZZT, $25 or better.

limit order book A list of unexecuted limit orders maintained by an exchange or dealer.

Limit Order Display Rule An SEC requirement that any exchange specialist or market maker who received a customer limit order priced at (or better than) his current quote must execute the order immediately, display the order to the entire marketplace, or route the order to an ECN (or another market maker) that would execute it or display it. See also ORDER HANDLING RULES.

limit order protection The obligation of exchange specialists and FINRA members to execute any customer limit orders held in their possession before positioning stock at an equal or better price in a proprietary account. A best execution obligation. See also MANNING RULE.

Limit Up/Limit Down (LU/LD) A Securities and Exchange Commission regulation that stipulates trading in a stock will be paused for a minimum of five minutes if the national best bid and offer (NBBO) price matches one of the upper or lower band limits for fifteen seconds. Under LU/LD, if the national best bid is priced below the lower band it will be non-executable. If the national best offer (NBO) is priced above the upper band it will be non-executable. Quotes outside the bands cannot be traded against.

limited order Another term for limit order, as in ZVZZT, I'm limited at a quarter, but I'd definitely make a sale there.

line of stocks A relatively large long or short position that was systematically accumulated. See also TAKE ON A LINE and PUT OUT A LINE.

linear hedge A hedging vehicle with payoffs that are almost exactly proportional to changes in market price of the underlying assets. Examples include futures contracts and forward contracts. As opposed to a NON-LINEAR HEDGE.

liquid Describes an asset that can easily be converted into cash.

liquid market A market where large quantities of stock can be bought or sold without significantly impacting the market price.

liquidate To close a position.

liquidating market A market experiencing aggressive selling even at successively lower prices. For example, Good God man, this market is liquidating right in front of our eyes.

liquidity The ability to trade relatively large quantities of stock without significantly impacting the market price. For example, Let's hope the liquidity stays reasonably high at least until we can get out of the name.

liquidity detection A GAMING strategy in which computers are programmed to continuously search the markets for large hidden orders. See also FLASH TRADING and PINGING.

liquidity event An event that generates such an abnormally high volume of activity that even a relatively large commitment can be liquidated without significantly affecting the market price.

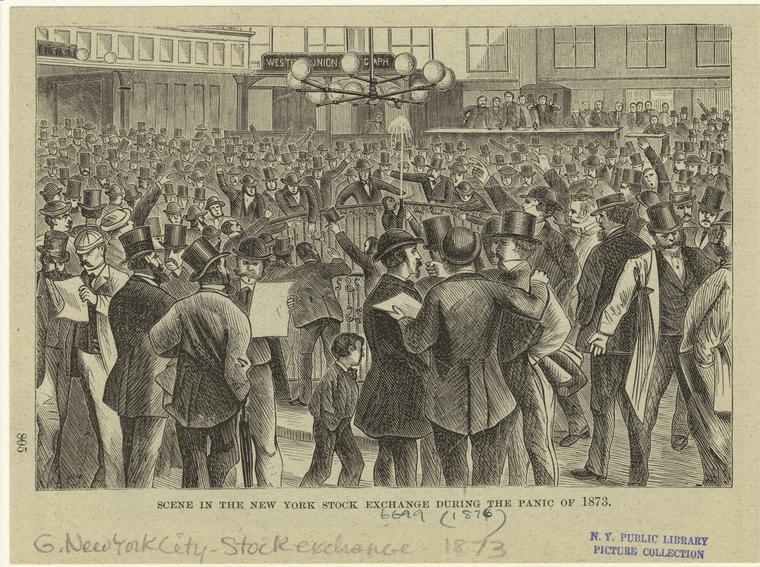

liquidity pools 1. Sources of order flow in a fragmented market. 2. See DARK POOLS.

Liquidity pool, 1873 (published 1875)

Liquidity pool, 1873 (published 1875)

Photo Credit: New York Public Library

liquidity posters Those who POST LIQUIDITY.

liquidity premium A transaction cost estimate that uses the quotation midpoint at the time of the trade as the benchmark. The liquidity premium essentially equals the difference between the actual trade price and the quote midpoint. The liquidity premium is used to determine the EFFECTIVE SPREAD.

liquidity provider A trader that regularly posts quotes, enters limit orders, or generally stands ready to commit capital in a specific stock.

liquidity rebate A partial refund of per share fees granted by exchanges and electronic communications networks to traders who post liquidity within their systems. See also LIQUIDITY TAKE FEE.

liquidity risk The risk associated with trading in a stock that cannot be bought or sold easily.

liquidity take fee A per share fee charged by exchanges and electronic communications networks to traders who enter market orders or marketable limit orders. See also LIQUIDITY REBATE.

liquidity trader See utilitarian trader.

Liquidnet An alternative trading system developed in 2001 that allows members to electronically negotiate trades directly with each other.

list 1. A specific group of stocks in which a particular dealer makes a market. For example, Go ahead and add ZVZZT to my list. See also PAD. 2. The aggregate of stocks that trade on a specific exchange.

listed (stock) A stock that is approved to trade on a physically convened stock exchange such as the New York Stock Exchange. Does not refer stocks trading on the NASDAQ.

listed trader An upstairs sell side trader who facilitates the execution of listed trades. May also make markets in listed stocks via the third market.

Little Board Originally industry jargon for the Consolidated Stock and Petroleum Exchange. Subsequently referred to the American Stock Exchange. See also BIG BOARD.

live The point at which a trader becomes interested in trading, as in XYZ, I live up at the $50.50 level.

load up To make a larger than advisable speculative commitment, as in If ZVZZT gets down to the $25 neighborhood, I am going to load up.

local An exchange based commodities, futures, or options trader that trades for his own proprietary account. A commodities trading version of FLOOR TRADER. Also known as a pit trader.

local stock exchanges See REGIONAL STOCK EXCHANGES.

locate Ascertain if shares are available to be borrowed for a short sale.

lock (a stock) Verb To make a two way market where the bid price and the offer price are equal, as in ZVZZT, I'll lock 50,000 at $25 to work larger. Used in an effort to attract natural customer order flow.

lock in To obtain trading exclusivity from a customer, as in If we front end 100,000 ZVZZT from your guy, do you think we can lock in at least 400,000 behind it?

locked in Describes a trader who is particularly reluctant to exit a position.

locked market A market in which the best bid equals the best offer, as in Right now, ZVZZT is locked at $25.10. See also CROSSSED MARKET.

logical market A market in which stock prices generally reflect overall economic conditions.

London Coffee House A coffee house established in Philadelphia, Pennsylvania in 1754. Quickly became the premier meeting place for the city's merchant traders and other prominent citizens, and remained so until the 1770s. The Coffee House was ultimately closed during the Revolutionary War and supplanted by the City Tavern after the War.

London Coffee House

Photo Credit: The Free Library of Philadelphia

long To own stocks, as in I am long of ZVZZT heading into the earnings print.

long account The aggregate of margin purchases made during a specified period. See also FOR THE LONG ACCOUNT.

long fail A trade in which the buyer does not deliver funds in the designated manner at the prescribed time (usually settlement date).

long of stocks To own stocks in anticipation of higher prices, as in I will be net long of stocks as long as we continue to see quantitative easing from the Fed.

long position Ownership of shares, as in ZVZZT, I may add another 50,000 shares to my long position if the stock drops another five percent.

long pull Describes a position held in expectation of a substantial future profit, as in I am in this stock for the long pull.

Long Room The room of the Open Board of Stock Brokers that was specifically dedicated to continuous trading. Predated continuous trading at the New York Stock Exchange by several years. After the Open Board merged with the New York Stock Exchange, a Long Room opened at the NYSE.

long side The side of the market preferred by traders who anticipate higher prices.

long squeeze A slang term for a situation in which traders with long positions are compelled to sell, or are frightened into selling, at a loss in a weak market. The opposite of (and less common than) a SHORT SQUEEZE.

long tack A speculator who is long of stocks is said to have "taken the long tack." Also known as the bull tack.

long term A period of time greater than six months.

long term investor See INVESTOR.

long the stock To own a stock, as in XYZ, I actually got long the stock back down at the $50 level.

longs, the The aggregate owners of shares, as in The longs sure have been right on XYZ … it’s ripping.

look Details provided by a specialist regarding recent trading activity, the current market, and indicated interest. For example, XYZ is $50 1/4 - 3/8, 10k by 20k, Bear on the buy side, Morgan and Monty on the sell side. Also known as a picture.

looking for A customer indication of interest on the buy side. For example, ZVZZT, I'm looking for 100,000 tight. What can you offer?

Los Angeles Oil Exchange See LOS ANGELES STOCK EXCHANGE.

Los Angeles Stock Exchange A regional exchange established in Los Angeles, California in 1889 as the Los Angeles Oil Exchange. In 1900, the exchange broadened its scope and was renamed the Los Angeles Stock Exchange. Merged with the San Francisco Stock Exchange in 1957 to form the Pacific Coast Stock Exchange.

lose Industry jargon meaning sell. For example, XYZ, I'd lose 25,000 at $50 for a number.

lose 'em (all) Industry jargon meaning "sell them all." For example, ZVZZT, work 100,000 to sell with a $25.50 low, but I'd lose 'em at $26.

loser A stock that has fallen in price, as in I am definitely not adding to that loser.

losing your shirt Sustaining a very substantial loss. For example, I'm glad your desk analyst talked me out of shorting ZVZZT. I would have lost my shirt on that one.

loss 1. The negative difference between the current market price of a stock and its initial cost. 2. The negative difference between the opening and closing prices of a particular trade.

loss ratio The ratio of the trading losses sustained from a particular customer to the commissions generated by that customer. Used by broker/dealers to monitor overall profitability with a particular account. For example, We're running a 25% loss ratio with you guys. Think you might throw us a couple of lay up trades to get that down some?

lot 1. The aggregate number of shares grouped into a single transaction. 2. An official unit of trading. See also ROUND LOT and ODD LOT. 3. One segment of an order that has been divided into multiple equal portions. For example, XYZ, sell 25,000 additional at $50, second lot. See also RELOAD.

lots of… The individual portions of a larger trading situation, as in XYZ, we've traded a total of 50,000 shares on the day in lots of 10,000.

Louisville Stock Exchange A regional stock exchange located in Louisville, Kentucky. Closed in 1935.

low 1. The minimum acceptable price entered as part of a sell limit order, as in ZVZZT, sell 50,000 with a $25.50 low. See also ULTIMATE LOW. 2. A synonym for low price, as in ZVZZT hit a low of $25.15 in early trading, then caught a bid and rallied to new highs.

low price The lowest executed trade price during a specific period of time, as in Yesterday, the low price in XYZ was $50.25.

low ball To show a bid to a seller substantially below the current market price, as in You can tell your guy that if he tries to low ball me, I will have no interest.

low touch trading Another term for electronic trading. See also HIGH TOUCH TRADING.

lower Below the current market price, as in XYZ, I have more to buy, but I live lower for now.

lowest offer See BEST OFFER.

lows, the A slang term for low price, as in It looks like XYZ is heading back down to the lows of the day.

luck A factor that may, or may not, have an effect on trading profitability.

LU/LD See LIMIT UP/LIMIT DOWN.

lull A period of market inactivity, as in If we get a lull in trading mid day today, I'm going to run downstairs and grab some street meat for lunch.

Copyright 2016 by Brian W. Leite. All rights reserved. Reproduction of all or part of this dictionary without explicit permission is prohibited..