MARKET STRUCTURE DICTIONARY

BY

BRIAN W. LEITE

An Insider's Guide to the Real Language of

Trading and Exchanges

Over 2700 Entries

M A written abbreviation for thousand (M is the Roman numeral for thousand). Therefore, 10M would equal 10,000. See also K.

machine readable news News and social media content that is delivered in a format that allows NEWS TRADERS running trading algorithms to automatically and quickly consume, process, analyze, and act up on it. Many prominent news outlets offer such a service to high frequency traders.

machines A general slang term for computerized order execution systems. Now often refers more specifically to high frequency traders or algorithmic trading systems. For example, XYZ, buy 100,000 from now to the bell. You can just throw it in the machines if you would like.

Main Room The original trading floor of the New York Stock Exchange. Dates to the original construction of the building in 1903. Located at 18 Broad Street.

Main Room, 1917

Photo Credit: Museum of American Finance

Main Street Industry jargon for the general public. Populated by non-professional traders. As opposed to WALL STREET.

major bracket firm See BULGE BRACKET FIRM.

make (making) An abbreviation of make a market. For example, How are you making ZVZZT? --- I'm $25 1/4-1/2, fifty up.

make a market 1. To continuously quote a bid and an offer for a stock and stand ready to trade at that quote. To act as a dealer. For example, I currently make a market in fifty stocks. 2. To quote a specific bid and/or offer for a particular customer. For example, I’ll make ZVZZT $24.90 - $25.10, 50,000 up for your guy. See also SPECIALIST and MARKET MAKER.

make a price To create a specific bid and/or offer at the request of a customer. Also known as make a market or name a price.

make a sale Another term for "sell some stock." For example, XYZ, I'd make a sale at the $0.50 level.

make delivery See DELIVERY.

making a line Industry lingo for sideways price movement over a period of time. For example, XYZ has been making a line all day. It’s like watching grass grow.

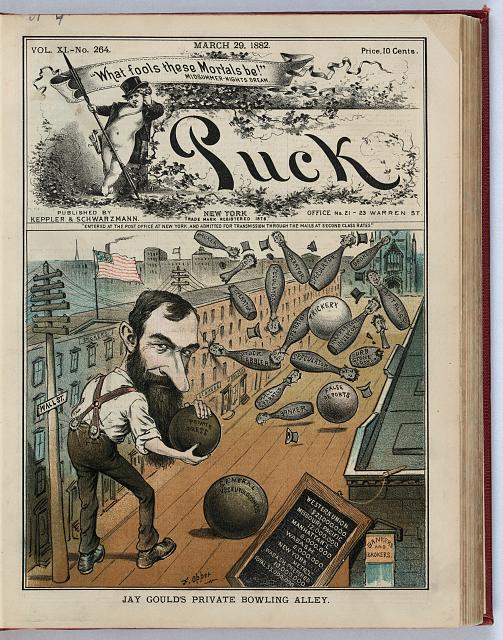

manipulation To cause a stock to trade at an artificial price through questionable or illegal trading methods.

Jay Gould, master manipulator, 1882

Photo Credit: Library of Congress

Manning Rule A FINRA regulation the provides LIMIT ORDER PROTECTION by prohibiting member firms from trading ahead of their customers. Specifically, members must not trade in a proprietary account at a price equal to or superior than any customer limit order held without also executing the limit order at the price at which the firm traded (or better). Best execution obligations apply to any firm accepting a customer order whether or not the order is executed through the member itself or routed to another venue for execution.

manual quotation Any quote other than an AUTOMATED QUOTATION.

margin 1. Using borrowed funds to partially finance a stock position. Known as margin trading. 2. The difference between the market value of a position and the amount of any loan secured against the position.

margin account A account that allows a customer to partially finance trades and positions.

margin trading Using borrowed funds to partially finance a stock position.

markdown The amount subtracted from the per share price of a stock when it is sold by a customer to an over-the-counter dealer. For all intents and purposes, represents the dealer's commission. See also MARKUP and COMMISSION EQUIVALENT.

marker Historically, a term for a clerk that marked trades or quotes on a blackboard.

market 1. An organized forum for traders to trade. 2. An abbreviation for stock market, as in There was a broad rally in the market today.

market bid Another term for best bid.

market bottom The lowest price reached during a specific period of time, as in The market hit bottom about 10:30am and then worked its way higher for the rest of the session.

market breadth The portion of the market that is participating in a particular move. For example, The breadth of the market decline was less pronounced today than it has been for the past several days.

market break A sudden and sharp decline in prices, as in The market broke hard on the opening, but it recovered most of its losses to only close down 0.25% on the day.

market by price Describes the arrangement of bids and offers in a limit order book.

market capital Another term for market capitalization.

market capitalization (cap) The total market value of a company. Equals shares outstanding multiplied by the market price.

market center 1. Any exchange market maker, OTC market maker, alternative trading system, or national securities exchange. 2. See NASDAQ MARKET CENTER.

market consolidation Describes a situation in which traders tend to all trade in the same market center. According to economic theory, markets consolidate naturally because traders seek liquid markets, therefore the market with the most liquidity will attract more traders, which in turn will create more liquidity. Therefore, MARKET FRAGMENTATION is not a natural state, but rather the result of regulatory intervention.

market correction A reversal in the overall price trend of at least 10%. Usually refers to a down move. For example, After that huge run, I'd be surprised if we didn't see some sort of market correction.

market data rules Methodology established by Regulation NMS to allocate revenues derived from the sale of quote and trading data to each trading venue based on that venue's contribution to price discovery (as defined by Reg NMS).

market depth The ability of a market to absorb trades of substantial size without significantly affecting the market price.

market fragmentation Describes a situation in which an identical item can be traded in different market centers. With a significant increase in market regulation since 1997 giving rise to alternative trading systems and a proliferation of exchanges, the modern "stock market" has become highly fragmented. As opposed to MARKET CONSOLIDATION.

market (held) order An order to buy or sell a specific quantity of stock immediately and at the best prevailing market price. Must not contain any trading restrictions. For example, ZVZZT, buy 10,000 at the market, you're held. Go get 'em. See also MARKET NOT HELD ORDER.

market if touched order (MIT order) A conditional buy (or sell) order that automatically converts to a market order if the stock price falls (or rises) to a certain predetermined market price. Similar to a stop (loss) order except the actions are reversed. Also known as a board order.

market impact costs The costs associated with the order execution process. Also known as price impact costs.

market information system A general term for any system used to catalogue and display information regarding orders, quotes, and trades.

market instinct The ability to accurately interpret market data.

market jitters Anxiety over market conditions, as in The market needs to shake these jitters if we're ever going to move higher.

market laggard An underperforming stock, as in ZVZZT has really lagged the market since they missed on earnings.

market leader An active stock that sets the tone for the rest of the market, as in Yet again, XYZ led the market to new highs today.

market liquidity The ability to trade large quantities of stock without significantly impacting market prices. For example, Boy, the liquidity in the market completely dried up mid day today. More so than usual even.

market maker A firm or an individual who maintains firm two way quotes and stands ready to trade at those quoted prices. A dealer in securities. A market maker on an upstairs trading desk (cash equity trading desk, flow derivatives trading desk, delta one trading desk, etc.) often also facilitates the execution of customer orders either as principal, as riskless principal, or as agent. See also AUTOMATED MARKET MAKING.

Market Maker ID (MMID) A four letter code assigned to each NASDAQ market making firm. Similar to a stock symbol. For example, MSCO = Morgan Stanley, NITE= Knight Capital, etc.

market maker spread The difference between the bid price and the offer price quoted by a dealer. For example, a quote from a market maker of "$25.25-$25.50, 5k up" would have a spread of $0.25.

market manipulation To cause a stock to trade at an artificial price through illegal trading methods.

market maven An old term for an especially knowledgeable trader.

market meltdown A severe decline in prices. For example, I don't think it’s a good sign when the market melts down right after the President speaks.

market microstructure A branch of financial economics concerned with the organization of markets and the details of trading. Focuses on how exchange mechanisms, trading rules, transaction costs, and market risks affect the price formation process.

market not held order A market order that gives the trader fairly wide discretion as to how, when, and at what price to execute the order. The trader will not automatically be held responsible for a lack of participation in any particular print. Most orders from institutional customers default to not held. For example, Day around buy 10,000 ZVZZT market not held cans $25. --- Got it, let me go to work.

market offer Another term for best offer.

market on close order (MOC order) An order to buy or sell a specific quantity of stock at the official exchange closing price, as in Take an order to sell 15,000 XYZ market on close.

market on open order An order to buy or sell a specific quantity of stock at the official exchange opening price, as in Let’s buy 10,000 shares of ZVZZT market on open, then buy an additional 15,000 over the first hour.

market order An order to buy or sell a specific quantity of stock at the best prevailing price. For example ZVZZT, sell 25,000 at the market. Keep me up. See also MARKET (HELD) ORDER and MARKET NOT HELD ORDER.

market order/participate A market not held order that instructs the trader to work with volume regardless of the market price. For example, Sell 25,000 XYZ at the market, just participate. Keep me up please. Also known as market order/go along. See also PERCENTAGE ORDER.

market order/go along A market not held order that instructs the trader to work with volume regardless of the market price. For example, ZVZZT, buy 50,000 at the market, just go along with volume. Let me know if it gets out of hand. Also known as market order/participate. See also PERCENTAGE ORDER.

market overhang A situation in which the price of a stock is relatively weak because a large block is for sale, or is rumored to be for sale.

market price The current value of a share of stock. Refers either to the last reported sale (listed stocks) or the current inside bid/asked quote (over-the-counter stocks).

market reporter Another term for floor reporter.

market risk The risk associated with price fluctuations.

market sentiment The mass psychology of the market, as in Market sentiment turned decidedly negative after the Fed announcement.

market share The percentage of total volume traded by a particular broker/dealer. For example, Joe, we really need to pick up our market share this month. Use the balance sheet if you have to.

market structure 1. The aggregate of rules (formal and informal) and systems used to facilitate trading. See also MARKET MICROSTRUCTURE.

market structure analyst An analyst that focuses on the manner in which exchange mechanisms (both formal and informal), trading rules, transaction costs, and market risks affect the price formation process.

market swoon A slang term for a decline in the overall market, as in The market did swoon a little in early trading before regaining its footing and ending the day higher.

market tone The overall sentiment of the market as indicated by trading activity, as in The tone of the market was positive overall today, although there were a few notable laggards.

market top The highest price reached during a specific period, as in It looks like last week might have been the market top for a while.

market turn A reversal in trend, as in The market turned positive around 2:00pm and ended the day up a full percentage point.

market value 1. See MARKET PRICE. As opposed to FUNDAMENTAL VALUE. 2. See MARKET CAPITALIZATION (CAP).

marketability The ease at which shares can be sold into a secondary market.

marketable limit order 1. In general, a limit order that is priced close enough to the current market price to be potentially executable. 2. More specifically, a buy limit order that is priced at or above the best ask or a sell limit order that is priced at or below the best bid.

marketable order A general term for any order that is priced close enough to the current market price to be potentially executable. See also MARKETABLE LIMIT ORDER.

marketable securities Securities that can be easily converted to cash because they trade in relatively liquid secondary markets.

markup The amount added to the per share price of a stock when it is purchased by a customer from an over-the-counter dealer. For all intents and purposes, represents the dealer's commission. See also MARKDOWN and COMMISSION EQUIVALENT.

match price See INDICATIVE MATCH PRICE.

matched and lost Historically, the negative result of a coin toss between two floor brokers holding orders of equal standing competing for stock. The winner would execute his order while the loser would get nothing (matched and lost).

matched orders A situation in which two floor brokers holding orders of equal standing split stock evenly with each other.

matched volume The total amount of shares in a particular stock that have paired off naturally for the opening auction/cross or closing auction/cross. For example, Right now, XYZ is looking $50.25 on 250,000 for the opening.

matching engine The electronic nerve center of most modern exchanges and ECNs. Essentially the computerized version of the specialist (or all of the specialists combined). Matching engines electronically pair off incoming marketable buy and sell orders according to the rules of the venue.

matching orders The illegal operation of simultaneously entering essentially identical buy and sell orders in a stock in order to create the illusion of volume. See also WASH SALE.

material information Corporate information that will likely have an impact on the stock price upon release.

material nonpublic information Corporate information that is not known by the general public and will likely have an impact on the stock price upon release.

maven See MARKET MAVEN.

May Day May 1, 1975. The day that U.S. brokerage firms switched from standardized fixed commissions to negotiated commission rates.

medium An INDICATION OF INTEREST that expresses a general willingness to buy or sell about 15,000 to 25,000 shares with a customer depending on the relationship, the market price, and the available liquidity. For example, ZVZZT, I'm out as a medium buyer. I'd stand up for 15,000 right here. See also SMALL, LARGE, and SIZE.

medium capitalization (cap) stock The stock of a corporation with a market value in the $1 billion to $5 billion range.

medium term A period of time from approximately two months to six months. Also known as intermediate term.

mega capitalization (cap) stock The stock of a corporation with a very high market value. A general threshold is $200 billion.

melt up A rapid and very strong increase in prices, as in There was a melt up in the equities markets today following an unexpected drop in the discount rate. Basically a play on the word MELTDOWN.

meltdown A severe decline in prices, as in Who would have thought that missing earnings by five percent would cause a complete meltdown in the stock?

member One who holds a seat on an exchange. Must be officially approved by the exchange. May be an individual designated by a member organization to execute trades on the floor of the exchange.

member corporation A incorporated broker/dealer that possesses at least one membership on a particular stock exchange. However, exchange rules traditionally dictated that the membership must be held in the name of an individual officer/shareholder and not in the name of the firm itself.

member firm A broker/dealer organized as a partnership or LLC that possesses at least one membership on a particular stock exchange. However, exchange rules have traditionally dictated that the membership must be held in the name of an individual partner or officer and not in the name of the firm itself.

mental stop The unofficial price at which a trader believes he should exit a position. Also known as a soft stop. As opposed to a HARD STOP.

menu A range of choices presented by a dealer to a customer who desires to trade a block. For example, ZVZZT, I'll offer you 25,000 at $30, 50,000 at $30 1/4, or 100,000 at $30 1/2. Often involves capital commitment on the part of the dealer.

merchandise Industry jargon for order flow. For example, ZVZZT, we have some good merchandise to shop today. Let’s try to put a few trades on.

merchant adventurer An archaic term for a merchant who made a business of importing and/or exporting goods on speculation. A distant cousin of the modern day stock speculator.

merchant traders A relatively small class of businessmen who engaged in the trading of commodities (and sometimes securities) in early America. Later, certain prominent New York merchant traders would sign the Buttonwood Agreement, establish the Tontine Coffee House, and ultimately form the New York Stock and Exchange Board.

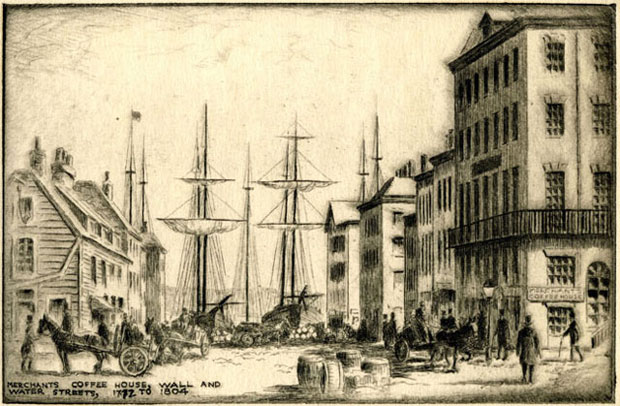

Merchants' Coffee House (New York) A tavern established around 1737 on the corner of Wall and Water Streets in Manhattan. Originally a sailors' sung harbor and watering hole for pirates and privateers, the Coffee House gradually developed into a general meeting place for local merchants. Ultimately the Coffee House became the premier meeting place (and unofficial exchange) for prominent merchant traders in colonial New York. Destroyed by a fire in 1804. See also TONTINE COFFEE HOUSE.

Merchants Coffee House

Photo Credit: Collection of the New-York Historical Society

Merchants' Coffee House and Place of Exchange (Philadelphia) See CITY TAVERN.

micro capitalization (cap) stock The stock of a corporation with a low market value, usually under $250 million.

mid capitalization (cap) stock The stock of a corporation with a market value in the $1 billion to $5 billion range.

middle office The information technology services and risk management functions of a financial services firm. See also FRONT OFFICE and BACK OFFICE.

middle price The price half way between the bid price and offer price quoted by a dealer.

midpoint When describing the QUOTATION MIDPOINT means the average of the best bid and the best offer. Often used as a trading benchmark.

Midwest Stock Exchange A regional stock exchange formed in 1949 by the merger of the Chicago, St. Louis, Cleveland, and Minneapolis/St. Paul stock exchanges. It was renamed the Chicago Stock Exchange in 1993. Today, the Chicago Stock Exchange operates as an automated trading platform primarily trading NYSE and NASDAQ stocks.

mil In the U.S. equity markets, a unit of measurement equal to 1/1000 of $1 or 1/10 of a penny.

milking Manipulating a stock in such a way as to extract maximum profits at the expense of other market participants. Was usually the prerogative of the most powerful operators and cliques. For example, It looks like the Commodore is not done squeezing the shorts yet. He is really milking this one.

minimum or none order An order that stipulates that a minimum quantity of shares must be executed all at once or not at all. If there is insufficient liquidity to execute the minimum quantity during the trading day, the order will be cancelled at the close of the market.

minimum price fluctuation The smallest incremental price movement allowed by an exchange for a particular stock.

Mining Exchange A successful, but short lived, exchange in New York City. Was an early organized exchange practitioner of continuous trading rather than call market trading. Closed as a result of the Panic of 1857. See also NEW YORK MINING EXCHANGE.

Minneapolis/St. Paul Stock Exchange A regional exchange located in the Minneapolis/St. Paul area. Merged with the Chicago Stock Exchange, the Cleveland Stock Exchange, and the St. Louis Stock Exchange in 1949 to form the Midwest Stock Exchange.

Minsky moment In general, the point at which a market falls into crisis following a sustained period of speculative activity.

minus tick A trade that occurs at a price that is lower than the price of the trade immediately proceeding it. Also known as a downtick. See also ZERO MINUS TICK.

Miscellaneous Securities Board A securities exchange founded in New York City by local commodities traders. Merged with the New York Mining Stock and National Petroleum Exchange in 1883.

missed the stock 1. A situation in which a trader receives an order from a customer, but stock trades away before the trader has the opportunity to access the market. The result of unfortunate timing. For example, Just fyi, ZVZZT we missed the stock at a dime. I'm working for you there now though. See also TRADES AHEAD. 2. A situation in which a trader holds a customer order and stock trades away without the trader participating. Potentially (but not necessarily) the result of negligence. For example, You mean to tell me that you missed ALL of that stock that traded at a quarter!? See also AWAY FROM US.

MIT order An abbreviation of market if touched order.

mixed bag A slang term for a group of stocks with a wide range of returns, as in I know the overall numbers are okay, but if you look closely, there is definitely a mixed bag in that portfolio.

mixed lot An order that contains one or more round lots plus an odd lot.

mixed market A market without a clear trend, as in The market ended the day mixed after trading mostly higher earlier in the session.

mixed trading Describes trading activity in a market without a clear trend, as in Trading was mixed after market leader XYZ preannounced earnings before the opening.

MM A written abbreviation for million. Therefore, 10MM would equal 10,000,000.

MMID An abbreviation of Market Maker ID.

mo An abbreviation of momentum. For example, That guy is a real mo trader. No stock is ever too expensive for him.

MOC order An abbreviation of market on close order.

mock trading A simulated trading environment used for educational purposes. Also known as paper trading.

model driven trading A trading strategy in which computers are programmed to make buy and sell decisions based on mathematical analysis of measurable data. Also known as quantitative trading. See also HIGH FREQUENCY TRADING.

model risk The risk that an arbitrageur does not properly account for relationships between the various financial instruments contained within a hedge portfolio.

momentum The perceived impetus behind a price and/or volume movement. Momentum traders tend to buy shares as they are rising and sell (or short) shares as they are falling. For example, As the rally gathered momentum, more buyers emerged, and the market spiked into the close.

momentum trading Owning/ buying stocks with rising prices, and selling/ shorting stocks with falling prices.

momentum ignition A HIGH FREQUENCY TRADING strategy that employs GAMING techneques in an effort to to induce other market participants to trade more quickly and aggressively than they otherwise would, thereby causing a rapid (and likely unwarranted) price movement.

momo play A slang term for a trade based on momentum rather than on fundamentals.

monopolist An individual dealer who has sufficient control over a particular stock to effectively set the terms under which other traders are allowed to trade. Historically, primary exchange specialists were, for all intents and purposes, monopolists in each of their stocks.

month order See GOOD THIS MONTH ORDER.

more behind A trader's term to indicate that a stated size reflects only a portion of the entire trading interest, as in ZVZZT, I have 50,000 to buy in here, more behind.

most active list A list of the stocks with the highest trading volume on a given day.

move 1. A synonym for sell. For example, I need to move 100,000 ZVZZT by the bell. 2. A change in price. For example, That move to the downside was quite a surprise given all of the good news that came out this morning.

multiple listing A situation in which a stock is listed on more than one exchange simultaneously.

multiple six figure size An amount of stock greater than about 300,000 shares. See also SIZE.

multiple sixes An abbreviation of multiple six figure size, as in XYZ, I can bring out multiple sixes in line.

mutual fund A pool of money managed by a professional registered investment company.

Copyright 2016 by Brian W. Leite. All rights reserved. Reproduction of all or part of this dictionary without explicit permission is prohibited..